In finance, a spread trade (also known as a relative value trade) is the simultaneous purchase of one security and sale of a related security, called legs...

5 KB (749 words) - 19:25, 12 September 2024

Options strategy (redirect from Spread trading)

correctly. The bull call spread and the bull put spread are common examples of moderately bullish strategies. Mildly bullish trading strategies are options...

16 KB (2,200 words) - 08:08, 27 September 2024

(ISBN 0-471-67876-7) Futures Spread Trading by Steven A. Mitchell Seasonality at futures market by SeasonAlgo Detailed description for futures spread trading by SeasonAlgo...

4 KB (452 words) - 04:43, 27 June 2024

spread, building blocks of option trading strategies. Spread trade, between two related securities or commodities Spread option, payoff is based on the difference...

3 KB (379 words) - 08:12, 17 February 2024

Energy portal Crack spread is a term used on the oil industry and futures trading for the differential between the price of crude oil and petroleum products...

7 KB (1,017 words) - 20:47, 23 August 2020

known as "trading inside the spread". Effective spreads account for this issue by using trade prices, and are typically defined as: Effective Spread = 2 ×...

8 KB (1,076 words) - 18:17, 10 March 2023

Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple...

25 KB (3,865 words) - 06:21, 9 October 2024

the trading and hedging opportunities. The terms dark spread, quark spread and bark spread refer to the similarly defined differences ("spreads") between...

13 KB (1,906 words) - 04:06, 16 August 2024

to pay higher yield spreads. I-spread Option-adjusted spread Spread trade Yield curve Yield spread premium Z-spread Credit Spread Curve, fincyclopedia...

4 KB (529 words) - 07:30, 12 April 2024

originally referred to as spread trading. Scalping is a trading style where small price gaps created by the bid–ask spread are exploited by the speculator...

32 KB (4,173 words) - 02:45, 23 October 2024

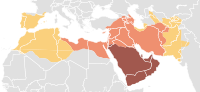

Trans-Saharan trade is trade between sub-Saharan Africa and North Africa that requires travel across the Sahara. Though this trade began in prehistoric...

32 KB (3,835 words) - 13:09, 30 October 2024

In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options...

7 KB (1,034 words) - 11:36, 15 January 2024

owing to the emphasis attached to Islamic teachings. Trade played an important role in the spread of Islam in some parts of the world, such as Indonesia...

85 KB (10,515 words) - 10:56, 30 October 2024

created by the bid–ask spread, or a fraudulent form of market manipulation. Scalping, in the arbitrage sense, is a type of trading in which traders try...

12 KB (1,719 words) - 08:19, 22 August 2024

In options trading, a bull spread is a bullish, vertical spread options strategy that is designed to profit from a moderate rise in the price of the underlying...

3 KB (377 words) - 09:25, 16 July 2022

Spreadeagle (position) (redirect from Spread-eagle position)

The spreadeagle (also spelled spread eagle or spread-eagle) is the position in which a person has their arms outstretched and legs apart, figuratively...

14 KB (1,428 words) - 22:19, 4 July 2024

professional and retail clients to trade financial markets. In 2006, the former CMC Markets CFO, Ajay Pabari, founded Spread Co, as a specialist provider of...

4 KB (410 words) - 19:44, 9 October 2024

an option spread trade involving two or more options. Essentially, it is the volatility at which the theoretical value of the spread trade matches the...

3 KB (524 words) - 02:10, 14 October 2023

Contract for difference (section Retail trading)

Financial betting Financial spread betting Futures contract Parimutuel betting Prediction market Point shaving Sports betting Spread trade Technical analysis Turbo...

41 KB (4,805 words) - 17:32, 6 October 2024

In options trading, a vertical spread is an options strategy involving buying and selling of multiple options of the same underlying security, same expiration...

1 KB (161 words) - 20:12, 3 November 2021

options are generally traded over the counter, rather than on exchange. A 'spread option' is not the same as an 'option spread'. A spread option is a new,...

4 KB (479 words) - 22:28, 25 October 2024

A crush spread is a commodity trading strategy in which the trader takes a long position in soybean futures against short positions in soybean meal futures...

4 KB (422 words) - 01:57, 15 November 2022

another exchange within any given month. As with any other spread trade, an intermarket spread attempts to profit from the widening or narrowing of the...

877 bytes (112 words) - 21:00, 12 April 2022

this particular kind of spread trade is called a variance dispersion trade. Sell a correlation swap. In practice, exchange-traded funds (ETF's) are sometimes...

5 KB (616 words) - 03:57, 22 January 2024

The Z-spread, ZSPRD, zero-volatility spread, or yield curve spread of a bond is the parallel shift or spread over the zero-coupon Treasury yield curve...

4 KB (611 words) - 11:21, 27 August 2024

A trade union (British English) or labor union (American English), often simply referred to as a union, is an organization of workers whose purpose is...

82 KB (9,171 words) - 20:35, 16 October 2024

at risk Scenario analysis Short (finance) Speculation Day trading Position trader Spread trade Standard of deferred payment Store of value Time horizon...

68 KB (5,693 words) - 07:48, 10 October 2024

The underwriting spread is the difference between the amount paid by the underwriting group in a new issue of securities and the price at which securities...

2 KB (197 words) - 18:34, 5 February 2022

milliseconds. In January 2014, Spread Networks announced that it had opened a point of presence at the NYSE Euronext trading center located in Mahwah, New...

9 KB (897 words) - 22:57, 27 June 2024

moves down, the pairs trade would be to short the outperforming stock and to long the underperforming one, betting that the "spread" between the two would...

10 KB (1,328 words) - 13:25, 2 February 2024