finance, the capital asset pricing model (CAPM) is a model used to determine a theoretically appropriate required rate of return of an asset, to make decisions...

35 KB (4,588 words) - 09:36, 5 November 2024

asset pricing refers to a formal treatment and development of two interrelated pricing principles, outlined below, together with the resultant models...

12 KB (1,075 words) - 14:17, 1 October 2024

arbitrage pricing theory (APT) is a multi-factor model for asset pricing which relates various macro-economic (systematic) risk variables to the pricing of financial...

19 KB (2,580 words) - 09:40, 22 November 2024

objective capital asset pricing model. Even without the assumption of an agreement, it is possible to set rational limits on capital asset value. For...

10 KB (1,174 words) - 07:39, 26 September 2024

The consumption-based capital asset pricing model (CCAPM) is a model of the determination of expected (i.e. required) return on an investment. The foundations...

3 KB (377 words) - 04:51, 6 December 2023

Outline of finance (section Asset pricing models)

Equilibrium pricing Equities; foreign exchange and commodities Capital asset pricing model Consumption-based CAPM Intertemporal CAPM Single-index model Multiple...

68 KB (5,693 words) - 07:48, 10 October 2024

Intertemporal CAPM (redirect from Intertemporal capital asset pricing model)

intertemporal capital asset pricing model, or ICAPM, is an alternative to the CAPM provided by Robert Merton. It is a linear factor model with wealth as...

5 KB (1,533 words) - 04:55, 6 December 2023

Business valuation (redirect from Butler-Pinkerton model)

traditional CAPM model. They include, for example, the arbitrage pricing theory (APT) as well as the consumption-based capital asset pricing model (CCAPM). Furthermore...

59 KB (8,224 words) - 21:56, 21 August 2024

key input into cost of capital calculations such as those performed using the capital asset pricing model. The cost of capital at risk then is the sum...

11 KB (1,560 words) - 18:21, 30 June 2023

Rational pricing is the assumption in financial economics that asset prices – and hence asset pricing models – will reflect the arbitrage-free price of the...

26 KB (3,730 words) - 08:01, 27 May 2024

In asset pricing and portfolio management the Fama–French three-factor model is a statistical model designed in 1992 by Eugene Fama and Kenneth French...

13 KB (1,644 words) - 20:22, 17 July 2024

generally extensions of the single-factor capital asset pricing model (CAPM). The multifactor equity risk model was first developed by Barr Rosenberg and...

10 KB (1,790 words) - 05:46, 22 August 2024

Downside risk (category Financial risk modeling)

the capital asset pricing model (CAPM) assumes: that security distributions are symmetrical, and thus that downside and upside betas for an asset are...

8 KB (1,007 words) - 17:09, 26 January 2023

is dividends, P0 is price of the stock, and g is the growth rate. There are 3 ways of calculating Ke: Capital Asset Pricing Model Dividend Discount Method...

8 KB (1,206 words) - 10:04, 3 July 2024

Alpha, along with beta, is one of two key coefficients in the capital asset pricing model used in modern portfolio theory and is closely related to other...

9 KB (1,108 words) - 08:50, 30 August 2024

Modern portfolio theory (category Financial risk modeling)

Tim Bollerslev (2019). "Risk and Return in Equilibrium: The Capital Asset Pricing Model (CAPM)" Hui, C.; Fox, G.A.; Gurevitch, J. (2017). "Scale-dependent...

52 KB (7,909 words) - 07:35, 11 November 2024

defined as volatility, rather than allocation of capital. The risk parity approach asserts that when asset allocations are adjusted (leveraged or deleveraged)...

38 KB (4,000 words) - 18:58, 5 November 2024

estimation of the required return by the capital asset pricing model as above, is the use of the Fama–French three-factor model. The expected return (or required...

16 KB (2,279 words) - 21:21, 28 June 2024

suggest that the capital asset pricing model has been empirically invalidated. various other models are proposed (see asset pricing), although all are...

30 KB (2,937 words) - 22:24, 18 November 2024

any asset, such as stocks, bonds, or derivatives. The theoretical return is predicted by a market model, most commonly the capital asset pricing model (CAPM)...

5 KB (718 words) - 23:10, 10 August 2023

Economic Sciences. Sharpe was one of the originators of the capital asset pricing model (CAPM). He created the Sharpe ratio for risk-adjusted investment...

11 KB (1,188 words) - 04:33, 20 July 2024

Upside risk (category Financial risk modeling)

information to investors than does only looking at the single Capital Asset Pricing Model (CAPM) beta. The comparison of upside to downside risk is necessary...

3 KB (279 words) - 11:22, 16 June 2022

Fama–MacBeth regression (category Financial models)

is a method used to estimate parameters for asset pricing models such as the capital asset pricing model (CAPM). The method estimates the betas and risk...

5 KB (796 words) - 02:34, 29 May 2024

short previous 12-month loser stocks. Capital asset pricing model (CAPM) Factor investing Fama–French three-factor model Momentum factor Returns-based style...

5 KB (811 words) - 10:12, 20 May 2024

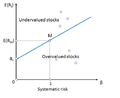

Security market line (SML) is the representation of the capital asset pricing model. It displays the expected rate of return of an individual security...

4 KB (609 words) - 14:45, 26 May 2024

Valuation (finance) (redirect from Asset prices)

value Undervalued stock Valuation risk Specific pricing models Capital asset pricing model Arbitrage pricing theory Black–Scholes (for options) Fuzzy pay-off...

44 KB (4,842 words) - 20:22, 4 November 2024

returns predicted by pricing models. Therefore, anomalous market returns may reflect market inefficiency, an inaccurate asset pricing model or both. This problem...

3 KB (366 words) - 16:20, 12 November 2024

credited. The main principle behind the model is to hedge the option by buying and selling the underlying asset in a specific way to eliminate risk. This...

65 KB (9,573 words) - 14:21, 12 November 2024

imperfect. Therefore, human capital pressures security prices and thus causes deviations from the Capital Asset Pricing Model (CAPM). The market value of...

8 KB (1,405 words) - 21:56, 15 February 2024

arbitrage pricing theory, which argued that security returns are best explained by multiple factors. Prior to this, the Capital Asset Pricing Model (CAPM)...

13 KB (1,585 words) - 11:10, 3 October 2024