The real interest rate is the rate of interest an investor, saver or lender receives (or expects to receive) after allowing for inflation. It can be described...

15 KB (2,119 words) - 15:00, 25 April 2024

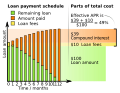

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The...

36 KB (4,273 words) - 11:12, 7 November 2024

contrast with the real interest rate). Compound interest (also referred to as the nominal annual rate). The concept of real interest rate is useful to account...

6 KB (862 words) - 14:24, 16 April 2024

Interest rate parity is a no-arbitrage condition representing an equilibrium state under which investors compare interest rates available on bank deposits...

24 KB (3,086 words) - 09:09, 5 September 2024

representing future goods, that the real rate of interest is observed. Rothbard has said that Interest rate is equal to the rate of price spread in the various...

71 KB (10,075 words) - 22:42, 19 November 2024

effective interest rate (EIR), effective annual interest rate, annual equivalent rate (AER) or simply effective rate is the percentage of interest on a loan...

4 KB (503 words) - 20:02, 21 June 2024

The neutral rate of interest, previously called the natural rate of interest, is the real (net of inflation) interest rate that supports the economy at...

10 KB (1,319 words) - 07:10, 11 August 2022

Zero interest-rate policy (ZIRP) is a macroeconomic concept describing conditions with a very low nominal interest rate, such as those in contemporary...

7 KB (628 words) - 21:30, 17 November 2024

real interest rate is approximately the historical nominal interest rate minus inflation. Looking forward into the future, the expected real interest...

11 KB (1,714 words) - 23:42, 9 November 2024

In the United States, the federal funds rate is the interest rate at which depository institutions (banks and credit unions) lend reserve balances to...

31 KB (3,089 words) - 09:20, 21 November 2024

the real present value of their loan repayments), while they are worse off if there is a drop in inflation that lowers interest rates. Fixed-rate mortgages...

13 KB (2,101 words) - 20:04, 19 April 2024

as effective annual percentage rate (EAPR), annual equivalent rate (AER), effective interest rate, effective annual rate, annual percentage yield and other...

18 KB (2,603 words) - 09:19, 17 November 2024

In finance, an interest rate swap (IRS) is an interest rate derivative (IRD). It involves exchange of interest rates between two parties. In particular...

33 KB (3,803 words) - 10:17, 29 October 2024

A variable-rate mortgage, adjustable-rate mortgage (ARM), or tracker mortgage is a mortgage loan with the interest rate on the note periodically adjusted...

38 KB (5,193 words) - 21:57, 14 August 2024

interest rates (such as the federal funds rate in the United States), the overall economy is primarily affected by the long-term real interest rates charged...

6 KB (869 words) - 03:12, 2 December 2023

Fisher equation (category Interest rates)

nominal interest rates, real interest rates, and inflation. Named after Irving Fisher, an American economist, it can be expressed as real interest rate ≈ nominal...

5 KB (528 words) - 05:47, 28 November 2023

Inflation (redirect from Inflation rate)

rate of interest will see a reduction in the "real" interest rate as the inflation rate rises. The real interest on a loan is the nominal rate minus the...

122 KB (14,086 words) - 11:21, 10 November 2024

yields a unique combination of the interest rate and real GDP. The IS curve shows the causation from interest rates to planned investment to national income...

29 KB (3,737 words) - 16:10, 11 November 2024

rate) plus the inflation rate of the euro minus the inflation rate of the dollar. The Real Exchange Rate (RER) represents the nominal exchange rate adjusted...

43 KB (5,575 words) - 02:29, 22 November 2024

Fisher effect (category Interest)

proposed that the real interest rate is independent of monetary measures (known as the Fisher hypothesis), therefore, the nominal interest rate will adjust...

4 KB (587 words) - 11:42, 26 December 2023

in the interest rate, inflation and output. The MP curve displays a positive relationship, upward-sloping curve, where the real interest rate is located...

3 KB (328 words) - 18:05, 24 December 2023

such as prices, wages, and exchange rates, with no effect on real variables, like employment, real GDP, and real consumption. Neutrality of money is an...

13 KB (1,737 words) - 04:25, 15 November 2023

appropriately setting short-term interest rates. The rule considers the federal funds rate, the price level and changes in real income. The Taylor rule computes...

22 KB (2,816 words) - 00:00, 29 July 2024

Yield curve (redirect from Term structure of interest rates)

thought to be related to investor expectations for the economy and interest rates. Ronald Melicher and Merle Welshans have identified several characteristics...

45 KB (5,682 words) - 21:54, 6 April 2024

measure of responsiveness of the growth rate of consumption to the real interest rate. If the real interest rate rises, current consumption may decrease...

7 KB (1,463 words) - 20:23, 12 February 2024

Present value (section Choice of interest rate)

compare the change in purchasing power, the real interest rate (nominal interest rate minus inflation rate) should be used. The operation of evaluating...

23 KB (3,862 words) - 05:44, 31 May 2024

exhibits the classical dichotomy if real variables such as output and real interest rates can be completely analyzed without considering what is happening...

4 KB (478 words) - 04:25, 15 November 2023

Mortgage (redirect from Mortgage interest)

generic term for a loan secured by such real property. As with other types of loans, mortgages have an interest rate and are scheduled to amortize over a...

55 KB (7,250 words) - 18:06, 17 November 2024

percentage rate of charge (APR), corresponding sometimes to a nominal APR and sometimes to an effective APR (EAPR), is the interest rate for a whole...

31 KB (4,395 words) - 21:43, 23 September 2024

It can be formalized as follows: I=f(r,ΔY,q) - + + where r is the real interest rate, Y the GDP and q is Tobin's q. The signs under the variables simply...

2 KB (212 words) - 15:16, 23 August 2024