The efficient-market hypothesis (EMH) is a hypothesis in financial economics that states that asset prices reflect all available information. A direct...

49 KB (5,873 words) - 07:39, 2 July 2024

of a stock's future price could yield significant profit. The efficient market hypothesis suggests that stock prices reflect all currently available information...

23 KB (2,742 words) - 03:38, 29 July 2024

adaptive market hypothesis, as proposed by Andrew Lo, is an attempt to reconcile economic theories based on the efficient market hypothesis (which implies...

10 KB (1,187 words) - 18:57, 23 March 2024

Capital Markets Studies. 7 (1): 72–90. doi:10.1108/JCMS-12-2022-0046. ISSN 2514-4774. Investopedia ULC (2009). "Efficient Market Hypothesis - EMH". Jegadeesh...

11 KB (1,250 words) - 14:40, 11 March 2024

Technical analysis (category Foreign exchange market)

efficacy of technical analysis is disputed by the efficient-market hypothesis, which states that stock market prices are essentially unpredictable, and research...

58 KB (7,227 words) - 13:32, 19 August 2024

(consistently producing market-beating returns is considered to be very unlikely according to the efficient market hypothesis). Miller once said, "As...

13 KB (1,404 words) - 22:41, 7 September 2023

Stock trader (redirect from Stock market trader)

extreme events (“black swans”). Market Memory: Contradicting the efficient market hypothesis, the authors claim that markets have memory, affecting future...

35 KB (4,419 words) - 17:08, 14 July 2024

Buy and hold (section Efficient-market hypothesis)

is a high correlation between the stock market and economic growth. According to the efficient-market hypothesis (EMH), if every security is fairly valued...

5 KB (626 words) - 05:50, 15 July 2024

The random walk hypothesis is a financial theory stating that stock market prices evolve according to a random walk (so price changes are random) and thus...

11 KB (1,496 words) - 08:32, 6 August 2024

Informationally Efficient Markets" (PDF). American Economic Review. 70 (3): 393–408. Lo, Andrew (2007). "Efficient market hypothesis". In Blume, Steven;...

3 KB (264 words) - 16:58, 4 February 2024

Eugene Fama (section Efficient market hypothesis)

his empirical work on portfolio theory, asset pricing, and the efficient-market hypothesis. He is currently Robert R. McCormick Distinguished Service Professor...

15 KB (1,473 words) - 04:11, 20 July 2024

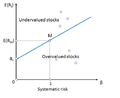

ratio will be below. Indeed, from the efficient market hypothesis it follows that it's impossible to beat the market. Therefore, all portfolios should have...

3 KB (427 words) - 04:03, 9 December 2021

antonym of closed market Prediction market Real estate market Stock market Wholesale marketing Efficient-market hypothesis, economic theory that asset prices...

3 KB (343 words) - 14:15, 14 August 2024

A Random Walk Down Wall Street (category Efficient-market hypothesis)

cannot consistently outperform market averages. The book is frequently cited by those in favor of the efficient-market hypothesis. As of 2023, there have been...

3 KB (268 words) - 12:55, 15 March 2023

on the outlook for an aggregate market rather than for a particular financial asset. The efficient-market hypothesis is an assumption that asset prices...

19 KB (2,236 words) - 11:58, 22 May 2024

below (see figure above). Indeed, from the efficient market hypothesis, it follows that we cannot beat the market. Therefore, all assets should have a Treynor...

4 KB (609 words) - 14:45, 26 May 2024

would be better able than the than "the market" in telling that there is mispricing (see Efficient-market hypothesis). Rather, it simply assumes that mispricing...

4 KB (430 words) - 07:54, 11 July 2024

according to the efficient-market hypothesis, existing share prices always include all the relevant related information for the stock market to make accurate...

38 KB (4,463 words) - 16:34, 31 July 2024

In finance, the noisy market hypothesis contrasts the efficient-market hypothesis in that it claims that the prices of securities are not always the best...

2 KB (156 words) - 21:33, 21 September 2023

capital contributes to a stock's return growth. The efficient-market hypothesis (EMH) is a hypothesis in financial economics that states that asset prices...

67 KB (7,365 words) - 13:49, 9 August 2024

Relatedly, return predictability by itself does not disprove the efficient market hypothesis, as one needs to show predictability over and above that implied...

33 KB (2,154 words) - 06:42, 11 January 2024

Outline of finance (section Market and instruments)

(trade) & Supply chain finance Corporate budget Active management Efficient market hypothesis Portfolio Modern portfolio theory Capital asset pricing model...

69 KB (5,698 words) - 08:33, 15 August 2024

EMH may refer to: Efficient-market hypothesis, a hypothesis in financial economics that states that asset prices reflect all available information Emergency...

557 bytes (98 words) - 21:43, 23 May 2023

realism. In the book the author argues that the efficient-market hypothesis (EMH) theory of financial markets is not only wrong but not even a theory. He...

11 KB (1,471 words) - 17:10, 11 July 2024

are the bubbles that occur in experimental asset markets. According to the efficient-market hypothesis, this doesn't happen, and so any data is wrong....

12 KB (1,516 words) - 05:26, 5 May 2024

efficient-market hypothesis say that asset prices reflect all available information meaning that it is impossible to systematically beat the market by...

10 KB (1,203 words) - 00:13, 18 June 2024

consensus on its explanation, posing challenges to the efficient market hypothesis and random walk hypothesis. Due to the higher turnover and no clear risk-based...

12 KB (1,474 words) - 16:10, 6 July 2024

Behavior of Stock Market Prices, which found that stock market prices follow a random walk, proposing the Efficient Market Hypothesis, that randomness...

167 KB (19,605 words) - 14:56, 23 August 2024

The joint hypothesis problem is the problem that testing for market efficiency is difficult, or even impossible. Any attempts to test for market (in)efficiency...

3 KB (362 words) - 01:46, 6 March 2023

Philosophical Society in 2001. He is a leading proponent of the efficient-market hypothesis, which contends that prices of publicly traded assets reflect...

10 KB (1,051 words) - 04:33, 20 July 2024