Taxation in Denmark consists of a comprehensive system of direct and indirect taxes. Ever since the income tax was introduced in Denmark via a fundamental...

24 KB (2,851 words) - 18:49, 3 November 2024

of Taxation (Danish: Skatteminister) is the head of the Ministry of Taxation and a member of the Cabinet. As the head of the Tax Ministry, the Danish tax...

3 KB (73 words) - 21:53, 21 November 2024

est.) female: 10.9% (2016 est.) Although the level of taxation in Denmark is among the highest in the world, the labor market participation rate is still...

78 KB (3,501 words) - 08:37, 11 November 2024

List of countries by tax rates (redirect from World taxation)

Archived from the original on 2021-05-06. Retrieved 2021-05-06. "Taxation and Investment in Argentina 2016" (PDF). Deloitte. Archived (PDF) from the original...

139 KB (5,447 words) - 10:45, 20 November 2024

taxation. Establishing a business in Denmark can be undertaken in a matter of hours and at very low costs. The Danish government operates a "Danish Business...

224 KB (20,557 words) - 17:43, 21 November 2024

The Danish Ministry of Taxation (Danish: Skatteministeriet) is a Ministry, headed by the Danish Tax Minister. The responsibilities of the ministry includes...

3 KB (128 words) - 23:06, 22 October 2024

shop closing (Lukkelov) Official days to use the flag in Denmark (in Danish) Office Holidays in Denmark (specific dates of holidays in the current year)...

10 KB (68 words) - 11:30, 7 September 2024

Kristian Jensen (category Ministers for taxation of Denmark)

Minister of Taxation from 2004 to 2010. Jensen is a member of the liberal party Venstre. He briefly served as acting chairman of Venstre in 2019. From...

8 KB (449 words) - 22:00, 21 November 2024

Frode Sørensen (politician) (category Ministers for taxation of Denmark)

Frode Sørensen (born 21 January 1946 at Toftlund) was a member of the Danish parliament representing the Social Democrats. He was Tax Minister from 21...

1 KB (70 words) - 21:54, 21 November 2024

Holger K. Nielsen (category Ministers for taxation of Denmark)

Minister for Taxation from 2012 to 2013. Born at Ribe, Nielsen studied social science and Danish at the University of Aarhus from 1973 to 1979, and in 1978 at...

9 KB (795 words) - 22:00, 21 November 2024

Troels Lund Poulsen (category Ministers for taxation of Denmark)

elected into parliament at the 2001 Danish general election. On 23 February 2010, he was appointed as Minister of Taxation, while Karen Ellemann took over...

13 KB (675 words) - 22:02, 21 November 2024

basis for taxation is established in the German Constitution (Grundgesetz), which lays out the basic principles governing tax law. Most taxation is decided...

64 KB (8,181 words) - 12:44, 21 November 2024

agreements on avoidance of double taxation with countries such as Australia, Austria, Belgium, Bolivia, Brazil, Canada, Chile, Denmark, Finland, France, Germany...

8 KB (1,040 words) - 02:28, 28 July 2024

the most significant form of taxation in Australia, and collected by the federal government through the Australian Taxation Office (ATO). Australian GST...

35 KB (3,776 words) - 04:47, 22 November 2024

Capital of Denmark: Copenhagen Elections in Denmark Political parties in Denmark Taxation in Denmark Head of state (ceremonial): King of Denmark, Frederik...

17 KB (927 words) - 21:31, 2 August 2024

Svend Erik Hovmand (category Ministers for taxation of Denmark)

December 1945, in Sakskøbing) is former member of Folketinget, the Danish parliament. He was representing the Liberal Party. He was Tax Minister in the Cabinet...

2 KB (83 words) - 21:53, 21 November 2024

This is a list of tax ministers of Denmark since 1975. The collection of taxes was originally assumed by the Finance Ministry. The Finance Ministry's...

16 KB (315 words) - 21:53, 21 November 2024

has doubled in the same period. Denmark had the 6th best energy security in the world in 2014. Denmark has had relatively high energy taxation to encourage...

103 KB (10,182 words) - 19:32, 13 November 2024

Anders Fogh Rasmussen (category Ministers for taxation of Denmark)

S.K. (Danish pronunciation: [ˈɑnɐs ˈfɔwˀ ˈʁɑsmusn̩] ; born 26 January 1953) is a Danish politician who was the 24th Prime Minister of Denmark from November...

62 KB (6,089 words) - 03:02, 22 November 2024

usually limit the scope of their income taxation in some manner territorially or provide for offsets to taxation relating to extraterritorial income. The...

129 KB (10,823 words) - 02:45, 13 November 2024

Double taxation is the levying of tax by two or more jurisdictions on the same income (in the case of income taxes), asset (in the case of capital taxes)...

28 KB (3,937 words) - 05:26, 4 October 2024

Taxation in Sweden on salaries for an employee involves contributing to three different levels of government: the municipality, the county council, and...

19 KB (2,085 words) - 16:19, 10 October 2024

of Denmark applies. It consists of metropolitan Denmark—the kingdom's territory in continental Europe and sometimes called "Denmark proper" (Danish: egentlige...

56 KB (5,064 words) - 03:06, 22 November 2024

"No taxation without representation" (often shortened to "taxation without representation") is a political slogan that originated in the American Revolution...

77 KB (9,382 words) - 16:24, 4 November 2024

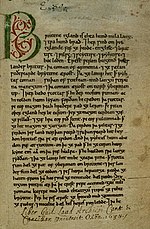

Taxation in medieval England was the system of raising money for royal and governmental expenses. During the Anglo-Saxon period, the main forms of taxation...

16 KB (2,202 words) - 16:41, 27 September 2024

Taxation in Israel include income tax, capital gains tax, value-added tax and land appreciation tax. The primary law on income taxes in Israel is codified...

15 KB (1,502 words) - 05:28, 21 September 2024

prohibited, as is a confiscatory rate of taxation. All people resident in Switzerland are liable for the taxation of their worldwide income and assets, except...

38 KB (3,312 words) - 14:45, 9 August 2024

Government of France for a wider perspective of French government. In France, taxation is determined by the yearly budget vote by the French Parliament...

55 KB (7,290 words) - 17:01, 26 July 2024

In Canada, taxation is a prerogative shared between the federal government and the various provincial and territorial legislatures. Under the Constitution...

61 KB (6,322 words) - 09:01, 5 November 2024