The United States federal child tax credit (CTC) is a partially-refundable tax credit for parents with dependent children. It provides $2,000 in tax relief...

83 KB (8,584 words) - 00:32, 10 November 2024

with the Child Tax Credit in the United States, only families making less than $400,000 per year may claim the full CTC. Similarly, in the United Kingdom...

8 KB (920 words) - 14:04, 26 October 2024

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working...

60 KB (7,619 words) - 20:56, 18 September 2024

Often such credits are refundable when total credits exceed tax liability. In the United Kingdom, the Child Tax Credit and Working Tax Credit were paid...

33 KB (4,001 words) - 18:51, 18 April 2024

renewed and enriched Child Tax Benefit (CTB) that consolidates the family allowance, the child credit and refundable child tax credit into a unified benefit...

13 KB (1,508 words) - 17:50, 3 November 2024

government (from child credits and the Earned Income Tax Credit). Taxes fall much more heavily on labor income than on capital income. Divergent taxes and subsidies...

119 KB (15,292 words) - 16:48, 11 November 2024

adoption tax credit is a tax credit offered to adoptive parents to encourage adoption in the United States. Section 36C of the United States Internal...

15 KB (1,350 words) - 14:32, 20 June 2024

The United States federal government and most state governments impose an income tax. They are determined by applying a tax rate, which may increase as...

140 KB (14,374 words) - 20:35, 9 September 2024

The Child Tax Credit Improvement Act of 2014 (H.R. 4935) is a bill that would amend the Internal Revenue Code with respect to the child tax credit. The...

9 KB (963 words) - 04:47, 16 April 2024

countries, such as the American Opportunity Tax Credit in the United States. Payments and refunds include estimated tax payments and amounts withheld from your...

12 KB (1,261 words) - 02:27, 12 September 2024

Section 9 defines a direct tax. The Sixteenth Amendment to the United States Constitution did not create a new tax. Taxes were low at the local, colonial...

56 KB (7,277 words) - 21:11, 3 November 2024

students, are scholarship tax credit programs. These allow individuals or corporations to receive tax credits toward their state taxes in exchange for donations...

34 KB (3,422 words) - 16:31, 21 November 2024

The United States Internal Revenue Service (IRS) uses forms for taxpayers and tax-exempt organizations to report financial information, such as to report...

48 KB (6,331 words) - 17:12, 29 August 2024

no income taxes and may actually receive a small subsidy from the federal government (from child credits and the Earned Income Tax Credit). "Progressivity"...

31 KB (3,390 words) - 05:40, 2 June 2023

the United States.: 14 German industrialist Wilhelm von Siemens proposed the concept of a value-added tax in 1918 to replace the German turnover tax. However...

96 KB (9,199 words) - 06:12, 14 November 2024

The Federal Unemployment Tax Act (or FUTA, I.R.C. ch. 23) is a United States federal law that imposes a federal employer tax used to help fund state workforce...

15 KB (1,686 words) - 12:07, 4 April 2024

in Title 18 of the United States Code (the federal criminal and penal code), but others fall under other titles. For instance, tax evasion and possession...

5 KB (550 words) - 16:14, 11 September 2024

In the United States, the combination of payroll taxes withheld from a household employee and the employment taxes paid by their employer are commonly...

11 KB (1,376 words) - 07:10, 15 February 2024

employment income (payroll taxes of the first type), under a system known as pay-as-you-go (PAYG). The individual states impose payroll taxes of the second type...

36 KB (4,066 words) - 17:44, 7 November 2024

Federal Insurance Contributions Act (redirect from Payroll tax in the United States)

Insurance Contributions Act (FICA /ˈfaɪkə/) is a United States federal payroll (or employment) tax payable by both employees and employers to fund Social...

41 KB (4,410 words) - 23:50, 6 September 2024

the United States, individuals and corporations pay a tax on the net total of all their capital gains. The tax rate depends on both the investor's tax bracket...

56 KB (6,629 words) - 19:09, 16 October 2024

In the United States, child support is the ongoing obligation for a periodic payment made directly or indirectly by an "obligor" (or paying parent or payer)...

84 KB (9,014 words) - 18:30, 22 November 2024

sum equivalent to the tax is paid, but reimbursed on exit. More common in Europe, tax-free is less frequent in the United States, with the exception of...

24 KB (3,093 words) - 07:32, 19 June 2024

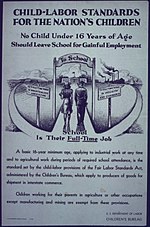

Child labor laws in the United States address issues related to the employment and welfare of working children in the United States. The most sweeping...

13 KB (1,649 words) - 19:51, 13 September 2024

(PDF), is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs Act (TCJA), that amended the Internal...

174 KB (16,845 words) - 12:05, 14 November 2024

The Household and Dependent Care Credit is a nonrefundable tax credit available to United States taxpayers. Taxpayers that care for a qualifying individual...

7 KB (1,019 words) - 00:46, 6 February 2023

Section 1 of the United States Constitution, the Full Faith and Credit Clause, addresses the duty that states within the United States have to respect...

19 KB (2,452 words) - 17:12, 7 September 2024

Party is one of the two major contemporary political parties in the United States. Since the late 1850s, its main political rival has been the Republican...

298 KB (23,375 words) - 01:48, 25 November 2024

estate taxes, capital gains taxes, and corporate taxes. Critics of the act claim that it worsened federal budget deficits, but supporters credit it for...

24 KB (2,496 words) - 22:01, 4 July 2024

Urban-Brookings Tax Policy Center, typically shortened to the Tax Policy Center (TPC), is a nonpartisan think tank based in Washington D.C., United States. A joint...

10 KB (903 words) - 02:08, 10 November 2024