A corporate tax, also called corporation tax or company tax, is a type of direct tax levied on the income or capital of corporations and other similar...

51 KB (5,675 words) - 00:28, 25 October 2024

Corporate tax is imposed in the United States at the federal, most state, and some local levels on the income of entities treated for tax purposes as...

62 KB (6,591 words) - 13:41, 7 October 2024

types of taxes: corporate tax, individual income tax, and sales tax, including VAT and GST and capital gains tax, but does not list wealth tax or inheritance...

139 KB (5,447 words) - 10:45, 20 November 2024

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for...

212 KB (19,738 words) - 04:21, 17 November 2024

debt, as well as after-tax incomes disproportionately for the most affluent. It led to an estimated 11% increase in corporate investment, but its effects...

174 KB (16,845 words) - 12:05, 14 November 2024

Corporate taxes in Canada are regulated at the federal level by the Canada Revenue Agency (CRA). As of January 1, 2019 the "net tax rate after the general...

33 KB (3,846 words) - 13:00, 8 August 2024

tax is self assessed, and individual and corporate taxpayers in all states imposing an income tax must file tax returns in each year their income exceeds...

85 KB (8,529 words) - 16:05, 16 September 2024

Tax evasion is an illegal attempt to defeat the imposition of taxes by individuals, corporations, trusts, and others. Tax evasion often entails the deliberate...

42 KB (4,975 words) - 21:12, 25 October 2024

the £ symbol refer to the Pound sterling. Corporation tax in the United Kingdom is a corporate tax levied in on the profits made by UK-resident companies...

105 KB (10,126 words) - 14:20, 3 August 2024

global minimum corporate tax rate, or simply the global minimum tax (abbreviated GMCT or GMCTR), is a minimum rate of tax on corporate income internationally...

38 KB (4,218 words) - 10:23, 19 November 2024

skilled workforce. The Netherlands has a large network of tax treaties, a low corporate income tax rate and a full participation exemption for capital gains...

23 KB (2,907 words) - 11:27, 11 August 2024

in Lithuania are taxed as a general taxable income, therefore personal income tax or corporate income tax apply. As of 2021, 15% tax rate is applied for...

105 KB (13,893 words) - 03:26, 18 October 2024

are within the law. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance should not...

70 KB (8,687 words) - 11:23, 29 September 2024

traditional tax havens and major corporate tax havens. Corporate tax havens often serve as "conduits" to traditional tax havens. Use of tax havens results...

244 KB (24,898 words) - 14:09, 4 October 2024

Corporate welfare refers to government financial assistance, subsidies, tax breaks, or other favorable policies provided to private businesses or specific...

25 KB (2,405 words) - 01:45, 14 October 2024

most scale taxes are progressive based on brackets of yearly income amounts. Most countries charge a tax on an individual's income and corporate income....

110 KB (14,332 words) - 06:55, 21 November 2024

Taxation in the Republic of Ireland (redirect from List of Irish tax defaulters)

duties (12% of ETR). Corporation taxes (16% of ETR) represents most of the balance (to 95% of ETR), but Ireland's Corporate Tax System (CT) is a central part...

130 KB (14,587 words) - 02:34, 21 September 2024

Taxation in the United Arab Emirates (category Value added taxes)

added tax, corporate income tax, and excise taxes. Some emirates levy property, transfer, excise and tourism taxes. Some emirates also charge corporate taxes...

21 KB (2,521 words) - 10:31, 9 November 2024

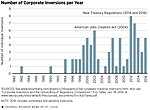

A tax inversion or corporate tax inversion is a form of tax avoidance where a corporation restructures so that the current parent is replaced by a foreign...

92 KB (9,812 words) - 21:45, 1 January 2024

potential tax rates around Europe for certain income brackets. It is focused on three types of taxes: corporate, individual, and value added taxes (VAT)....

41 KB (2,002 words) - 21:38, 23 October 2024

Ireland's Corporate Tax System is a central component of Ireland's economy. In 2016–17, foreign firms paid 80% of Irish corporate tax, employed 25% of...

259 KB (26,756 words) - 04:21, 17 November 2024

both aggregate supply as well as aggregate demand will be shifted. Corporate income tax cuts generate sustained effects on R&D expenditures, productivity...

32 KB (3,998 words) - 17:40, 26 August 2024

Taxation in Switzerland (redirect from Tax in Switzerland)

debts. Switzerland has a "classical" corporate tax system in which a corporation and its owners or shareholders are taxed individually, causing economic double...

38 KB (3,312 words) - 14:45, 9 August 2024

History of taxation in the United States (redirect from United States tax history)

Growth and Tax Relief Reconciliation Act of 2001, into law as part of a $1.35 trillion tax cut program. The United States' corporate tax rate was at...

56 KB (7,277 words) - 21:11, 3 November 2024

usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to...

45 KB (5,218 words) - 16:39, 8 November 2024

of the highest corporate tax rates. Tax choice is the theory that taxpayers should have more control with how their individual taxes are allocated. If...

15 KB (1,508 words) - 02:22, 19 October 2024

Ireland has been labelled as a tax haven or corporate tax haven in multiple financial reports, an allegation which the state has rejected in response....

217 KB (22,392 words) - 01:34, 21 September 2024

from taxation, as such tax was considered a form or double taxation on money earned by companies and subject to corporate tax. Currently, in most jurisdictions...

52 KB (6,228 words) - 15:52, 28 October 2024

tax revenue is derived or levied, e.g. income tax, estate tax, business tax, employment/payroll tax, property tax, gift tax and exports/imports tax....

11 KB (1,220 words) - 12:52, 25 May 2024

Taxation in Italy (redirect from Corporate tax in Italy)

Entrate). Total tax revenue in 2018 was 42.4% of GDP. The main earnings are income tax, social security, corporate tax and value added tax. All of these...

16 KB (2,006 words) - 19:46, 11 May 2024