A tax inversion or corporate tax inversion is a form of tax avoidance where a corporation restructures so that the current parent is replaced by a foreign...

92 KB (9,812 words) - 21:45, 1 January 2024

tax inversions in history, and Apple was over one–fifth of Irish GDP. Academics rank Ireland as the largest tax haven; larger than the Caribbean tax haven...

259 KB (26,756 words) - 04:21, 17 November 2024

Medtronic (category Tax inversions)

low corporation tax regime. Medtronic's tax inversion is the largest tax inversion in history, and given the changes in the U.S. tax-code in 2016 to block...

55 KB (4,721 words) - 04:00, 9 November 2024

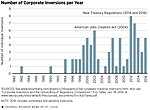

legal headquarters from a higher-tax home jurisdiction to a tax haven by executing a tax inversion. A "naked tax inversion" is where the corporate had little...

244 KB (24,898 words) - 14:09, 4 October 2024

Corporate haven (redirect from Corporate tax haven)

S. corporates execute tax inversions (see § Bloomberg Corporate tax inversions). Since the first U.S. corporate tax inversion in 1982, Ireland has received...

212 KB (19,738 words) - 04:21, 17 November 2024

Restaurant Brands International (category Tax inversions)

various sheltering techniques to reduce its tax rate to 27.5%. As a high-profile instance of tax inversion, news of the merger was criticized by U.S. politicians...

18 KB (1,583 words) - 17:25, 29 October 2024

Mallinckrodt (category Tax inversions)

headquartered in Ireland for tax purposes, its operational headquarters are in the U.S. Mallinckrodt's 2013 tax inversion to Ireland drew controversy when...

50 KB (5,094 words) - 19:48, 11 November 2024

of companies includes only publicly traded companies, also including tax inversion companies. There are also corporations having foundation in the United...

25 KB (207 words) - 16:17, 15 November 2024

Look up Inversion or inversion in Wiktionary, the free dictionary. Inversion or inversions may refer to: Inversion (artwork), a 2005 temporary sculpture...

4 KB (582 words) - 20:54, 10 June 2024

Tariff (redirect from Import tax)

A tariff is a tax imposed by the government of a country or by a supranational union on imports or exports of goods. Besides being a source of revenue...

79 KB (9,413 words) - 18:08, 20 November 2024

Perrigo (category Tax inversions)

Ireland for tax purposes, which accounts for 0.60% of net sales. In 2013, Perrigo completed the sixth-largest US corporate tax inversion in history when...

29 KB (2,548 words) - 05:40, 25 October 2024

types of taxes: corporate tax, individual income tax, and sales tax, including VAT and GST and capital gains tax, but does not list wealth tax or inheritance...

139 KB (5,447 words) - 10:45, 20 November 2024

Steris (category Tax inversions)

Companies portal Corporate tax inversions to Ireland Ireland as a tax haven Medtronic, another example of US medical device tax inversion to Ireland "STERIS Corp...

11 KB (917 words) - 17:43, 21 July 2024

Taxation in the Republic of Ireland (redirect from List of Irish tax defaulters)

most U.S. corporate tax inversions, and Medtronic (2015) was the largest U.S. tax inversion in history. Ireland's corporate tax system has base erosion...

130 KB (14,587 words) - 02:34, 21 September 2024

law would reduce the incentive for tax inversion, which is used today to obtain the benefits of a territorial tax system by moving U.S. corporate headquarters...

174 KB (16,845 words) - 12:05, 14 November 2024

Horizon Therapeutics (category Tax inversions)

executed a tax inversion to move its legal headquarters to Ireland to avail itself of Ireland's low tax rates and beneficial corporate tax system. In...

15 KB (1,256 words) - 03:55, 18 September 2024

Taxation in Sweden (redirect from Tax in Sweden)

tax. The employer makes monthly preliminary deductions (PAYE) for income tax and also pays the payroll tax to the Swedish Tax Agency. The income tax is...

19 KB (2,085 words) - 16:19, 10 October 2024

An ad valorem tax (Latin for "according to value") is a tax whose amount is based on the value of a transaction or of a property. It is typically imposed...

28 KB (4,337 words) - 22:45, 28 March 2024

Endo International (category Tax inversions)

executed a corporate tax inversion to Ireland to avoid U.S. corporate taxes on their U.S. drug sales, and to avail of Ireland's corporate tax system. In 1920...

27 KB (2,298 words) - 22:10, 5 November 2024

consumption tax is a tax levied on consumption spending on goods and services. The tax base of such a tax is the money spent on consumption. Consumption taxes are...

26 KB (3,372 words) - 15:36, 25 October 2024

Allergan (category Tax inversions)

Allergan plc was created from the 2015 merger and Irish corporate tax inversion of two companies, Irish-based Actavis plc and U.S.-based Allergan, Inc...

37 KB (2,790 words) - 22:15, 14 August 2024

taxes levied. These are : Provincial sales taxes or PST (French: Taxes de vente provinciale - TVP), levied by the provinces. Goods and services tax or...

11 KB (795 words) - 21:41, 21 November 2024

Burger King (category Tax inversions)

over the practice of tax inversions, in which a company decreases the amount of taxes it pays by moving its headquarters to a tax haven, a country with...

159 KB (14,221 words) - 21:38, 13 November 2024

Helen of Troy Limited (category Tax inversions)

tax inversion when it reorganized into a Bermuda company in 1993. This inversion prompted new federal legislation tightening the rules on inversion,...

11 KB (1,056 words) - 14:53, 15 October 2024

A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale...

105 KB (13,893 words) - 03:26, 18 October 2024

AbbVie (section Tax avoidance)

not be structured as a tax inversion, and that post the transaction, AbbVie would remain legally domiciled in the U.S. for tax purposes. The company divested...

42 KB (3,542 words) - 10:02, 1 November 2024

A regressive tax is a tax imposed in such a manner that the tax rate decreases as the amount subject to taxation increases. "Regressive" describes a distribution...

32 KB (3,789 words) - 20:18, 9 November 2024

A value-added tax (VAT or goods and services tax (GST), general consumption tax (GCT)) is a consumption tax that is levied on the value added at each...

96 KB (9,199 words) - 06:12, 14 November 2024

An indirect tax (such as a sales tax, per unit tax, value-added tax (VAT), excise tax, consumption tax, or tariff) is a tax that is levied upon goods...

32 KB (4,526 words) - 13:20, 10 November 2024

Excise (redirect from Excise tax)

An excise, or excise tax, is any duty on manufactured goods that is normally levied at the moment of manufacture for internal consumption rather than...

49 KB (6,948 words) - 23:38, 17 November 2024