income. Citizens and residents living and working outside the U.S. may be entitled to a foreign earned income exclusion that reduces taxable income....

6 KB (797 words) - 07:11, 22 January 2024

The foreign housing exclusion goes hand-in-hand with the foreign earned income exclusion. According to section 911(a) of the federal tax code, a qualified...

6 KB (965 words) - 10:50, 21 August 2023

Physical presence test (category United States federal income tax)

Income earned abroad may qualify for the foreign earned income exclusion, the foreign housing exclusion or deduction, as long as the income is earned...

7 KB (905 words) - 10:40, 8 September 2023

Foreign earned income exclusion for U.S. citizens or residents for income earned outside the U.S. when the individual met qualifying tests. Income from...

19 KB (2,344 words) - 07:34, 18 September 2024

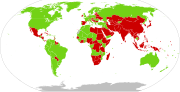

Taxation in the United States (section Income tax)

Nonetheless, the foreign earned income exclusion eliminates U.S. taxes on the first $120,000 of annual foreign source earned income of U.S. citizens and...

119 KB (15,262 words) - 09:56, 18 October 2024

Tax Increase Prevention and Reconciliation Act of 2005 (section Changes to Foreign Earned Income Exclusion (26 U.S.C. § 911))

for purposes of this limitation. The provision increases the Foreign Earned Income Exclusion (FEIE) and advances the inflation-adjustment provision that...

10 KB (1,325 words) - 12:50, 4 July 2024

Bona fide resident test (category United States federal income tax)

one way that an individual can qualify for the foreign earned income exclusion from United States income tax. In order to qualify for the bona fide residence...

4 KB (566 words) - 11:34, 28 November 2023

between Canada and the United States Financial Secrecy Index Foreign earned income exclusion Income tax in the United States International taxation#Citizenship...

154 KB (15,589 words) - 21:00, 5 September 2024

Double taxation (redirect from Directive on taxation of savings income in the form of interest payments)

personal allowance (such as the US foreign earned income exclusion) – income is taxed from the first penny earned. While double taxation agreements do...

28 KB (3,937 words) - 05:26, 4 October 2024

https://www.americansabroad.org/the_foreign_earned_income_exclusion_and_foreign_tax_credits_foreign_earned_income_exclusion Side-by-side Analysis of Residency-Based...

9 KB (1,016 words) - 21:41, 13 August 2024

S. tax relief principally through the foreign earned income exclusion, foreign housing exclusion, and/or foreign tax credit (claimed via IRS Forms 2555...

16 KB (2,089 words) - 00:14, 5 November 2024

instance, in 2018 the foreign earned income exclusion allowed up to US$103,900 of foreign salaried income to be exempt from income tax (in 2020, this was...

150 KB (18,329 words) - 14:46, 1 November 2024

Controlled foreign corporation (CFC) rules are features of an income tax system designed to limit artificial deferral of tax by using offshore low taxed...

17 KB (2,420 words) - 13:23, 27 March 2024

The U.S. foreign tax credit and Foreign Earned Income Exclusion reduce double taxation but do not eliminate it even for people whose income is well below...

163 KB (17,868 words) - 05:26, 24 September 2024

Accidental American (category United States federal income tax)

Revenue Code provides for a foreign earned income exclusion allowing non-resident U.S. tax filers to exclude wage income up to a certain threshold ($99...

48 KB (6,079 words) - 17:12, 31 August 2024

foreign investment company rules, and Controlled foreign corporation provisions. Tax rules recognize that some types of businesses do not earn income...

140 KB (14,374 words) - 20:35, 9 September 2024

original on 27 February 2006. Retrieved 23 December 2006. "Foreign Earned Income Exclusion", Internal Revenue Service, United States Department of the...

70 KB (8,687 words) - 11:23, 29 September 2024

entitled to the foreign earned income exclusion or the foreign housing exclusion/deduction under section 911 because 'foreign earned income' does not include...

53 KB (5,647 words) - 18:08, 31 August 2024

Gross income generally includes all income earned or received from whatever source with some exceptions. States are prohibited from taxing income from...

85 KB (8,529 words) - 16:05, 16 September 2024

by the corporation. Corporations may be subject to foreign income taxes, and may be granted a foreign tax credit for such taxes. Shareholders of most corporations...

62 KB (6,591 words) - 13:41, 7 October 2024

Table 1. Individual Income Tax Returns With Form 2555: Sources of Income, Deductions, Tax Items, and Foreign-Earned Income and Exclusions, by Size of Adjusted...

92 KB (7,739 words) - 16:39, 23 October 2024

Social exclusion or social marginalisation is the social disadvantage and relegation to the fringe of society. It is a term that has been used widely...

54 KB (6,263 words) - 11:51, 29 October 2024

of their income. Also exempted are U.S. citizens who qualify as residents of a foreign country under the IRS foreign earned income exclusion rule. In...

74 KB (6,947 words) - 20:02, 1 October 2024

17% of the benefits. The largest single tax expenditure was the exclusion from income of employer sponsored health insurance ($250 billion). Preferential...

130 KB (14,543 words) - 05:08, 2 November 2024

raise revenue (by eliminating the FICA cap; eliminating the foreign earned income exclusion, raising the taxes on capital gains, dividends, and bonds,...

37 KB (3,855 words) - 15:05, 30 July 2024

Tax exemption (section Exempt income)

Income earned outside the taxing jurisdiction. Such exclusions may be limited in amount. Interest income earned from subsidiary jurisdictions. Income...

24 KB (3,093 words) - 07:32, 19 June 2024

that they fall under one of the five exclusions in order to avoid tax consequences on the COD Income. The exclusions under Section 108 are justified under...

23 KB (3,368 words) - 01:26, 31 May 2023

IRS tax forms (redirect from Foreign earned income)

be used to claim a housing exclusion or deduction. A filer cannot exclude or deduct more than their foreign earned income for the tax year. Form 4868...

48 KB (6,331 words) - 17:12, 29 August 2024

it is not suitable for studying income mobility. A major gap in the measurement of income inequality is the exclusion of capital gains, profits made on...

209 KB (20,973 words) - 20:48, 30 October 2024

of their income. Also exempted are US citizens who qualify as residents of a foreign country under the IRS foreign earned income exclusion rule. In 2010...

116 KB (10,152 words) - 20:39, 4 October 2024