International trading tax stamp is kind of revenue stamps that were used in the Soviet Union in the 1920s and 1930s for taxation of the trade in stamps...

8 KB (890 words) - 21:34, 31 May 2024

Stamp duty is a tax that is levied on single property purchases or documents (including, historically, the majority of legal documents such as cheques...

19 KB (2,545 words) - 16:34, 18 November 2024

included in her platform a vow to "Impose a tax on high-frequency trading. The growth of high-frequency trading has unnecessarily placed stress on our markets...

113 KB (13,161 words) - 00:53, 17 October 2024

g. inheritance tax, expatriation tax, or tariff). In some countries, a stamp duty is imposed as an ad valorem tax. All ad valorem taxes are collected according...

28 KB (4,337 words) - 22:45, 28 March 2024

International tax planning also known as international tax structures or expanded worldwide planning (EWP), is an element of international taxation created...

9 KB (980 words) - 19:45, 12 November 2024

also impose wealth taxes, inheritance taxes, gift taxes, property taxes, sales taxes, use taxes, environmental taxes, payroll taxes, duties, or tariffs...

110 KB (14,332 words) - 06:55, 21 November 2024

stamps of Russia Definitive stamps of the Soviet Union First stamp of the Russian Empire First USSR stamps Gold Standard issue International trading tax...

32 KB (3,930 words) - 15:25, 20 October 2024

Tobin tax is not viable. First, it is virtually impossible to distinguish between normal liquidity trading and speculative noise trading. If the tax is generally...

157 KB (16,793 words) - 22:28, 26 September 2024

stamps of the Soviet Union First USSR stamps Gold Standard issue International trading tax stamp Leniniana List of paintings on Soviet postage stamps...

26 KB (2,315 words) - 20:23, 24 October 2024

Excise (redirect from Excise tax)

are aware of this, but it can be fined or seized if the "tax stamp" (represented by the tax capsule known as the "CRD" or "capsule représentative de droit")...

49 KB (6,948 words) - 23:38, 17 November 2024

The Tax Foundation is an international research think tank based in Washington, D.C. that collects data and publishes research studies on U.S. tax policies...

27 KB (2,403 words) - 16:10, 14 October 2024

Taxation in Hong Kong (redirect from Tax system in Hong Kong)

Salaries Tax, Property Tax and Profits Tax; the guiding statue is Inland Revenue Ordinance (Cap 112); Indirect tax – including Stamps Duty, Betting Duty,...

13 KB (1,713 words) - 23:27, 11 November 2024

property taxes. Examples include customs duty, excise duty, stamp duty, estate duty, and gift duty. A customs duty or due is the indirect tax levied on...

2 KB (272 words) - 12:54, 4 June 2023

Tariff (redirect from Import tax)

government, import duties can also be a form of regulation of foreign trade and policy that taxes foreign products to encourage or safeguard domestic industry...

79 KB (9,413 words) - 17:31, 23 November 2024

barriers for trading negatively affects the investors' willingness to trade, which in turn can change assets prices. Companies with tax-sensitive customers...

105 KB (13,893 words) - 03:26, 18 October 2024

Such treaties may cover a range of taxes including income taxes, inheritance taxes, value added taxes, or other taxes. Besides bilateral treaties, multilateral...

23 KB (3,032 words) - 11:14, 7 June 2024

Society of Philatelists First All-Union Philatelic Exhibition International trading tax stamp Leniniana (philately) Moscow Society of Philatelists and Collectors...

5 KB (351 words) - 13:12, 7 November 2024

tax Financial transaction tax Inheritance tax Spahn tax Real estate transfer tax Stamp duty Stamp duty in the United Kingdom Tobin tax Turnover tax Investopedia...

6 KB (897 words) - 23:30, 24 February 2024

In a tax system, the tax rate is the ratio (usually expressed as a percentage) at which a business or person is taxed. The tax rate that is applied to...

20 KB (2,752 words) - 05:06, 2 November 2024

Society of Philatelists First All-Union Philatelic Exhibition International trading tax stamp Leniniana (philately) Moscow Society of Philatelists and Collectors...

7 KB (528 words) - 08:23, 28 October 2024

quarters. In 1988, remains of the former Hanseatic trading house, once the largest medieval trading complex in Britain, were uncovered by archaeologists...

21 KB (2,578 words) - 11:30, 29 September 2024

broad categories: Income tax Payroll tax Property tax Consumption tax Tariff (taxes on international trade) Capitation, a fixed tax charged per person Fees...

13 KB (2,017 words) - 14:37, 31 October 2024

Taxation in the United Kingdom (redirect from Income tax in the United Kingdom)

securities) Schedule D (tax on trading income, income from professions and vocations, interest, overseas income and casual income) Schedule E (tax on employment...

59 KB (6,896 words) - 05:11, 19 November 2024

from payroll tax. Certain limited transactions in the British Virgin Islands are still subject to stamp duty. The main application of the stamp duty legislation...

28 KB (3,961 words) - 15:49, 3 November 2024

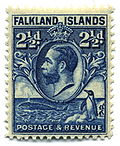

superseded by the Soviet Philatelic Association. Examples of international trading tax stamps issued by the Organisation 1923 1923 1925 All-Russian Society...

6 KB (427 words) - 21:10, 6 November 2024

Taxation in the Republic of Ireland (redirect from List of Irish tax defaulters)

objective. The balance of Ireland's taxes are Property taxes (<3% of ETR, being Stamp duty and LPT) and Capital taxes (<3% of ETR, being CGT and CAT). An...

130 KB (14,587 words) - 02:34, 21 September 2024

thematic stamp collecting is the collecting of postage stamps relating to a particular subject or concept. Topics can be almost anything, from stamps on stamps...

8 KB (714 words) - 04:12, 5 October 2024

Tax withholding, also known as tax retention, pay-as-you-earn tax or tax deduction at source, is income tax paid to the government by the payer of the...

25 KB (3,434 words) - 21:18, 6 October 2024

Tax competition, a form of regulatory competition, exists when governments use reductions in fiscal burdens to encourage the inflow of productive resources...

12 KB (1,346 words) - 05:22, 4 October 2024

inheritance tax. Many gifts are not subject to taxation because of exemptions given in tax laws. The gift tax amount varies by jurisdiction, and international comparison...

15 KB (1,417 words) - 11:33, 30 October 2024