finance, the capital asset pricing model (CAPM) is a model used to determine a theoretically appropriate required rate of return of an asset, to make decisions...

35 KB (4,613 words) - 01:24, 18 December 2024

asset pricing refers to a formal treatment and development of two interrelated pricing principles, outlined below, together with the resultant models...

12 KB (1,078 words) - 08:17, 18 December 2024

arbitrage pricing theory (APT) is a multi-factor model for asset pricing which relates various macro-economic (systematic) risk variables to the pricing of financial...

19 KB (2,580 words) - 09:40, 22 November 2024

objective capital asset pricing model. Even without the assumption of an agreement, it is possible to set rational limits on capital asset value. For...

10 KB (1,174 words) - 07:39, 26 September 2024

suggest that the capital asset pricing model has been empirically invalidated. various other models are proposed (see asset pricing), although all are...

30 KB (2,905 words) - 06:18, 12 February 2025

Upside risk (category Financial risk modeling)

information to investors than does only looking at the single Capital Asset Pricing Model (CAPM) beta. The comparison of upside to downside risk is necessary...

3 KB (279 words) - 20:54, 4 January 2025

Alpha, along with beta, is one of two key coefficients in the capital asset pricing model used in modern portfolio theory and is closely related to other...

9 KB (1,120 words) - 18:04, 22 January 2025

Downside risk (category Financial risk modeling)

the capital asset pricing model (CAPM) assumes: that security distributions are symmetrical, and thus that downside and upside betas for an asset are...

8 KB (1,007 words) - 17:09, 26 January 2023

Intertemporal CAPM (redirect from Intertemporal capital asset pricing model)

intertemporal capital asset pricing model, or ICAPM, is an alternative to the CAPM provided by Robert Merton. It is a linear factor model with wealth as...

5 KB (1,533 words) - 04:55, 6 December 2023

Outline of finance (section Asset pricing models)

Equilibrium pricing Equities; foreign exchange and commodities Capital asset pricing model Consumption-based CAPM Intertemporal CAPM Single-index model Multiple...

69 KB (5,696 words) - 08:05, 5 February 2025

key input into cost of capital calculations such as those performed using the capital asset pricing model. The cost of capital at risk then is the sum...

11 KB (1,560 words) - 17:01, 13 December 2024

The consumption-based capital asset pricing model (CCAPM) is a model of the determination of expected (i.e. required) return on an investment. The foundations...

3 KB (377 words) - 04:51, 6 December 2023

Business valuation (redirect from Butler-Pinkerton model)

traditional CAPM model. They include, for example, the arbitrage pricing theory (APT) as well as the consumption-based capital asset pricing model (CCAPM). Furthermore...

59 KB (8,266 words) - 11:25, 1 February 2025

In asset pricing and portfolio management the Fama–French three-factor model is a statistical model designed in 1992 by Eugene Fama and Kenneth French...

13 KB (1,591 words) - 20:19, 17 December 2024

returns predicted by pricing models. Therefore, anomalous market returns may reflect market inefficiency, an inaccurate asset pricing model or both. This problem...

3 KB (366 words) - 16:20, 12 November 2024

Valuation (finance) (redirect from Asset prices)

value Undervalued stock Valuation risk Specific pricing models Capital asset pricing model Arbitrage pricing theory Black–Scholes (for options) Fuzzy pay-off...

44 KB (4,842 words) - 06:51, 9 January 2025

Fama–MacBeth regression (category Financial models)

is a method used to estimate parameters for asset pricing models such as the capital asset pricing model (CAPM). The method estimates the betas and risk...

5 KB (796 words) - 02:34, 29 May 2024

Efficient-market hypothesis (redirect from Efficient capital markets)

asset prices, and frameworks such as consumption-based asset pricing and intermediary asset pricing can be thought of as the combination of a model of...

51 KB (6,283 words) - 17:19, 14 February 2025

Modern portfolio theory (category Financial risk modeling)

Tim Bollerslev (2019). "Risk and Return in Equilibrium: The Capital Asset Pricing Model (CAPM)" Hui, C.; Fox, G.A.; Gurevitch, J. (2017). "Scale-dependent...

52 KB (7,875 words) - 09:04, 5 February 2025

defined as volatility, rather than allocation of capital. The risk parity approach asserts that when asset allocations are adjusted (leveraged or deleveraged)...

38 KB (4,006 words) - 10:48, 17 January 2025

Rational pricing is the assumption in financial economics that asset prices – and hence asset pricing models – will reflect the arbitrage-free price of the...

26 KB (3,735 words) - 07:53, 23 December 2024

administrative officer or chief accounting officer CAPEX – Capital expenditure CAPM – Capital asset pricing model CBOE – Chicago Board Options Exchange CBOT – Chicago...

25 KB (2,475 words) - 11:52, 12 January 2025

generally extensions of the single-factor capital asset pricing model (CAPM). The multifactor equity risk model was first developed by Barr Rosenberg and...

10 KB (1,790 words) - 05:46, 22 August 2024

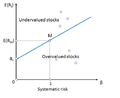

Security market line (SML) is the representation of the capital asset pricing model. It displays the expected rate of return of an individual security...

4 KB (609 words) - 14:45, 26 May 2024

Risk factor (finance) (section Model risk)

the capital asset pricing model, arbitrage pricing theory and other theories that use pricing kernels. In these models, the rate of return of an asset (hence...

18 KB (2,358 words) - 18:23, 30 July 2024

normally includes a risk premium which is commonly based on the capital asset pricing model. For discussion of the mechanics, see Valuation using discounted...

23 KB (3,387 words) - 15:00, 8 January 2025

Economic Sciences. Sharpe was one of the originators of the capital asset pricing model (CAPM). He created the Sharpe ratio for risk-adjusted investment...

11 KB (1,186 words) - 21:05, 11 January 2025

Black-Scholes model and Merton's application of the model to a continuous-time framework. Black also made significant contributions to the capital asset pricing model...

18 KB (1,914 words) - 19:36, 28 December 2024

Diversification (finance) (category Financial risk modeling)

comes from the capital asset pricing model which argues the maximum diversification comes from buying a pro rata share of all available assets. This is the...

25 KB (3,758 words) - 21:35, 10 July 2024

asset prices: A theory of market equilibrium under conditions of risk, Capital asset pricing model 1965 – John Lintner, The Valuation of Risk Assets and...

35 KB (3,961 words) - 15:29, 9 February 2025