The Land Tax was a land value tax levied in England from 1692 to 1963, though such taxes predate the best-known 1692 Act. It was abolished by the Finance...

28 KB (2,125 words) - 20:26, 14 November 2024

A land value tax (LVT) is a levy on the value of land without regard to buildings, personal property and other improvements upon it. Some economists favor...

83 KB (9,242 words) - 02:38, 11 November 2024

Stamp duty in the United Kingdom (redirect from Stamp Duty Land Tax)

The more modern versions of the tax no longer require a physical stamp. Stamp duty was first introduced in England on 28 June 1694, during the reign...

31 KB (3,487 words) - 18:52, 3 November 2024

estate transfer tax. This tax can be contrasted with a rent tax, which is based on rental income or imputed rent, and a land value tax, which is a levy...

83 KB (10,884 words) - 17:09, 14 June 2024

regions during the 19th century. The name "England" is derived from the Old English name Englaland, which means "land of the Angles". The Angles were one of...

227 KB (21,693 words) - 07:00, 16 November 2024

also impose wealth taxes, inheritance taxes, gift taxes, property taxes, sales taxes, use taxes, environmental taxes, payroll taxes, duties, or tariffs...

110 KB (14,332 words) - 09:33, 2 November 2024

Georgism (redirect from Single-tax movement)

recommendation is a tax assessed on land value, arguing that revenues from a land value tax (LVT) can be used to reduce or eliminate existing taxes (such as on...

154 KB (15,271 words) - 05:06, 3 October 2024

land taxes, although custom duties and fees to mint coins were also imposed. The most important tax of the late Anglo-Saxon period was the geld, a land tax...

16 KB (2,202 words) - 16:41, 27 September 2024

Window tax was a property tax based on the number of windows in a house. It was a significant social, cultural, and architectural force in England, France...

10 KB (1,209 words) - 22:17, 14 November 2024

Stamp duty (redirect from Stamp duty reserve tax)

Stamp Duty Land Tax only applies throughout England and Northern Ireland. In Scotland, SDLT was replaced by Land and Buildings Transaction Tax on April...

19 KB (2,545 words) - 16:34, 18 November 2024

Taxation in the United Kingdom (redirect from Income tax in the United Kingdom)

with income taxes and National Insurance contributions standing at around £470 billion. A uniform Land Tax, originally introduced in England during the...

59 KB (6,896 words) - 05:11, 19 November 2024

Tallage (category Property taxes)

may have signified at first any tax, but became in England and France a land use or land tenure tax. Later in England it was further limited to assessments...

8 KB (940 words) - 14:00, 5 November 2024

Council Tax is a local taxation system used in England, Scotland and Wales. It is a tax on domestic property, which was introduced in 1993 by the Local...

45 KB (4,854 words) - 11:52, 10 November 2024

A poll tax, also known as head tax or capitation, is a tax levied as a fixed sum on every liable individual (typically every adult), without reference...

47 KB (5,797 words) - 03:57, 8 November 2024

not earned, neither land value nor land value tax will affect production behavior (Hooper 2008). A sales tax is a consumption tax charged at the point...

28 KB (4,337 words) - 22:45, 28 March 2024

History of taxation in the United Kingdom (redirect from UK tax history)

and in 1670. The tax was eventually repealed in 1889. In 1692, the Parliament of England introduced its national land tax. This tax was levied on rental...

55 KB (7,064 words) - 15:55, 11 October 2024

International tax law distinguishes between an estate tax and an inheritance tax. An inheritance tax is a tax paid by a person who inherits money or property...

61 KB (7,091 words) - 15:30, 15 November 2024

Taxation in New Zealand (redirect from NZ tax)

income – income tax does apply to property transactions in certain circumstances, particularly speculation. There are currently no land taxes, but local property...

27 KB (3,130 words) - 18:57, 18 September 2024

Land Transaction Tax (LTT) (Welsh: Treth Trafodiadau Tir (TTT)) is a property tax in Wales. It replaced the Stamp Duty Land Tax from 1 April 2018. It...

7 KB (677 words) - 23:33, 9 November 2024

Danegeld (redirect from Danish tax)

defence of the realm, was known as heregeld (army-tax). In England, a hide was notionally an area of land sufficient to support one family; however their...

33 KB (4,237 words) - 20:16, 1 October 2024

Farm (revenue leasing) (redirect from Tax farm)

Farming or tax-farming is a technique of financial management in which the management of a variable revenue stream is assigned by legal contract to a...

16 KB (2,151 words) - 12:44, 8 November 2024

exchange for the payment of a type of inheritance tax. The Tenures Abolition Act 1660 declared that all land was to be held by socage tenure, ending the feudal...

6 KB (668 words) - 13:16, 3 May 2024

and removal costs. Stamp duty land tax (SDLT) is payable on property transactions in England and Northern Ireland. Tax is paid at different rates on different...

27 KB (2,810 words) - 12:12, 10 August 2024

income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income)...

45 KB (5,218 words) - 16:39, 8 November 2024

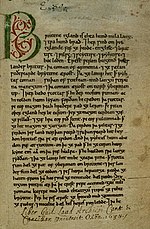

Saladin tithe (redirect from Saladin tax)

The Saladin tithe, or the Aid of 1188, was a tax (more specifically a tallage) levied in England and, to some extent, France, in 1188, in response to...

8 KB (1,009 words) - 10:35, 6 October 2024

History of taxation in the United States (redirect from United States tax history)

property taxes on land and commercial buildings. In addition, there were the state and federal excise taxes. State and federal inheritance taxes began after...

56 KB (7,277 words) - 21:11, 3 November 2024

late 18th century, political leaders from the New England colonies initiated resistance to Britain's taxes without the consent of the colonists. Residents...

169 KB (15,508 words) - 21:57, 15 November 2024

are within the law. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance should not...

70 KB (8,687 words) - 11:23, 29 September 2024

Taxation in the United States (redirect from Tax law (US))

separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital...

119 KB (15,292 words) - 16:48, 11 November 2024

Hide (unit) (redirect from Hide of land)

fortifications, manpower for the army (fyrd), and (eventually) the geld land tax. The hide's method of calculation is now obscure: different properties...

18 KB (2,791 words) - 00:06, 28 October 2024