The Black–Scholes /ˌblæk ˈʃoʊlz/ or Black–Scholes–Merton model is a mathematical model for the dynamics of a financial market containing derivative investment...

63 KB (9,359 words) - 05:27, 1 September 2024

In mathematical finance, the Black–Scholes equation, also called the Black–Scholes–Merton equation, is a partial differential equation (PDE) governing...

16 KB (2,815 words) - 00:45, 24 March 2024

The Black model (sometimes known as the Black-76 model) is a variant of the Black–Scholes option pricing model. Its primary applications are for pricing...

5 KB (794 words) - 07:43, 22 April 2024

Fischer Sheffey Black (January 11, 1938 – August 30, 1995) was an American economist, best known as one of the authors of the Black–Scholes equation. Fischer...

18 KB (1,822 words) - 17:57, 29 July 2024

Laureate in Economic Sciences, and co-originator of the Black–Scholes options pricing model. Scholes is currently the chairman of the Board of Economic Advisers...

12 KB (1,243 words) - 21:29, 4 April 2024

with the given strike, and is equal to the auxiliary N(d2) term in the Black–Scholes formula. This can also be measured in standard deviations, measuring...

22 KB (3,264 words) - 00:39, 31 May 2024

Option (finance) (section Black–Scholes)

option holdings. While the ideas behind the Black–Scholes model were ground-breaking and eventually led to Scholes and Merton receiving the Swedish Central...

52 KB (6,673 words) - 15:04, 22 August 2024

Itô's lemma (section Black–Scholes formula)

finance, and its best known application is in the derivation of the Black–Scholes equation for option values. Kiyoshi Itô published a proof of the formula...

25 KB (5,331 words) - 21:43, 14 June 2024

Binary option (section Black–Scholes valuation)

payout structure." In the Black–Scholes model, the price of the option can be found by the formulas below. In fact, the Black–Scholes formula for the price...

58 KB (6,722 words) - 20:08, 27 July 2024

underlying financial instrument, addressing cases where the closed-form Black–Scholes formula is wanting. The binomial model was first proposed by William...

16 KB (2,061 words) - 16:31, 8 January 2024

Valuation of options § Pricing models. The classical model here is Black–Scholes which describes the dynamics of a market including derivatives (with...

12 KB (1,076 words) - 08:45, 20 August 2024

called "Normal Model" equivalently (as opposed to "Log-Normal Model" or "Black-Scholes Model"). One early criticism of the Bachelier model is that the probability...

4 KB (446 words) - 13:17, 13 April 2024

included Myron Scholes and Robert C. Merton, who three years later in 1997 shared the Nobel Prize in Economics for having developed the Black–Scholes model of...

47 KB (5,612 words) - 05:43, 16 August 2024

underlying instrument which, when input in an option pricing model (usually Black–Scholes), will return a theoretical value equal to the price of the option....

15 KB (2,022 words) - 23:04, 17 August 2024

Scholes (the sch is pronounced sh or sk) may refer to: Scholes, in St Helens, Merseyside. Scholes, Greater Manchester, in Wigan Scholes, South Yorkshire...

3 KB (365 words) - 16:49, 8 December 2023

desired exposure; see for example delta hedging. The Greeks in the Black–Scholes model (a relatively simple idealised model of certain financial markets)...

44 KB (5,398 words) - 04:57, 28 June 2024

Merton's work and with Merton's assistance, Fischer Black and Myron Scholes developed the Black–Scholes model, which was awarded the 1997 Nobel Memorial...

29 KB (3,386 words) - 13:27, 14 August 2024

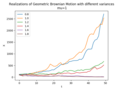

particular, it is used in mathematical finance to model stock prices in the Black–Scholes model. A stochastic process St is said to follow a GBM if it satisfies...

14 KB (2,237 words) - 18:08, 28 February 2024

emerged as a discipline in the 1970s, following the work of Fischer Black, Myron Scholes and Robert Merton on option pricing theory. Mathematical investing...

23 KB (2,426 words) - 21:17, 30 May 2024

of time t {\displaystyle t} . As such, it is a generalisation of the Black–Scholes model, where the volatility is a constant (i.e. a trivial function of...

23 KB (4,345 words) - 10:45, 15 May 2024

pricing research typically focuses on the quantization of the classical Black–Scholes–Merton equation from the perspective of continuous equations like the...

12 KB (1,544 words) - 22:09, 1 May 2024

financial crisis. In financial literature, it is not uncommon to derive the Black-Scholes formula by introducing a continuously rebalanced risk-free portfolio...

9 KB (1,616 words) - 17:34, 30 June 2023

parameter (implied volatility) that is needed to be modified for the Black–Scholes formula to fit market prices. In particular for a given expiration,...

12 KB (1,755 words) - 08:17, 3 May 2024

– an equilibrium-based result – and to the Black–Scholes–Merton theory (BSM; often, simply Black–Scholes) for option pricing – an arbitrage-free result...

120 KB (11,527 words) - 07:09, 30 August 2024

Black–Scholes equation for option pricing is a diffusion-advection equation (see however for a critique of the Black–Scholes methodology). The Black–Scholes...

31 KB (3,479 words) - 13:09, 26 July 2024

continuous-time option pricing model, the Black–Scholes–Merton model. In 1997 Merton together with Myron Scholes were awarded the Bank of Sweden Prize in...

27 KB (2,435 words) - 06:08, 27 August 2024

market efficiency lead to modern portfolio theory (the CAPM), and to the Black–Scholes theory for option valuation. At more advanced levels—and often in response...

64 KB (5,754 words) - 11:57, 2 September 2024

ideas in management and finance originated at the school, including the Black–Scholes model, the random walk hypothesis, the binomial options pricing model...

31 KB (3,073 words) - 02:52, 28 August 2024

developer during the second showing of Black Shoals in 2004. The name of the project is a pun on Black–Scholes, a widely used equation in financial derivatives...

2 KB (281 words) - 14:14, 28 January 2024

rule to be coded appropriately at each decision point. Closed form, Black–Scholes-like solutions are sometimes employed. These are applicable only for...

68 KB (7,135 words) - 14:32, 29 July 2024