Central Bank of Russia

| |

Head office erected in 1894 as the Moscow branch of the State Bank of the Russian Empire | |

| Headquarters | 12 Neglinnaya str., Moscow, Russia |

|---|---|

| Coordinates | 55°45′47″N 37°37′17″E / 55.76306°N 37.62139°E |

| Established | 1860 (original institution) 13 July 1990 (Bank of the RSFSR) 25 December 1991 (current name) |

| Governor | Elvira Nabiullina |

| Central bank of | |

| Currency | Russian ruble RUB (ISO 4217) |

| Reserves | US$608.2 billion (as of April 2022[update])[2] |

| Reserve requirements | International Reserves |

| Bank rate | 21.00%[3] |

| Preceded by | State Bank of the USSR |

| Website | cbr.ru/eng |

The Central Bank of the Russian Federation (Russian: Центральный банк Российской Федерации), commonly known as the Bank of Russia (Russian: Банк России),[4][5] also called the Central Bank of Russia (CBR),[6][7][8] is the central bank of the Russian Federation. The bank was established on 13 July 1990.[8] It traces its beginnings to the State Bank of the Russian Empire established in 1860.[9]

The bank is headquartered on Neglinnaya Street in Moscow. Its functions are described in the Constitution of Russia (Article 75),[10] as well as in federal law.[4]

History

[edit]

| This article is part of a series on |

| Banking in the Russian Federation |

|---|

|

| Russia portal |

Shortly after declaring sovereignty in June 1990, the Russian SFSR decreed the creation of a central bank under the leadership of Georgy Matiukhin. Matiukhin commandeered Russian branches of the State Bank of the USSR and brought them under the control of the Bank of the RSFSR. A comprehensive central bank statute was passed in December 1990 and the bank adopted a charter in June 1991. A remnant of the State Bank continued to operate alongside it until it was dissolved along with the Soviet Union in December 1991, and the Bank of Russia assumed its remaining business.[12]

Since 1992, the Bank of Russia began to buy and sell foreign currency on the foreign exchange market created by it, establish and publish the official exchange rates of foreign currencies against the ruble.

In 2006 capital controls mandate by the RCB began to ease, as confidence in the ruble mounted from the depths of the 1990s.[13] Legislation continued to ease through the 2010s.[13] The 2022 Russian invasion of Ukraine reversed this trend.[13]

In August 2023 the RCB raised the primary interest rate from 8.5% to 12%. At the same time president Vladimir Putin was said to be considering capital controls on exporters from Russia, who would have to convert 80% of foreign funds to the ruble. This would be done in order artificially to increase demand for the domestic currency.[14] In April 2024 this measure was prolonged for another year, from the original term of six months.[15] It was reported that "43 major Russian commodities groups" were affected.[15] At the time the ruble was trading at 93 to the US dollar.[15]

In October 2023 western firms that wanted to exit the Russian economy were doubly fleeced when they were told about extraordinary capital controls.[16] On 15 July 2024 the CBRF closed the statistics of the over-the-counter currency market; at the time it was under pressure from international sanctions over the Russian invasion of Ukraine.[17]

On 26 July 2024 the CBRF hiked its primary interest rate by 200 basis points to 18%.[18][19] In 2024 Q2, core inflation increased to 9.2% in annualised terms and labour shortages continued to grow.[18]

In September 2024 it was reported that the RCB had allowed the Rosoboronexport to buy US banknotes from the Rwandan Ministry of Defence while entities in Russia were interdicted from having US currency.[20]

On 13 September 2024 the RCB raised its primary interest rate to 19%.[21][22][23]

Role and duties

[edit]According to the constitution, it is an independent entity, with the primary responsibility of protecting the stability of the national currency, the ruble.[24]

Before 1 September 2013, it was the main regulator of the Russian banking industry, responsible for banking licenses, rules of banking operations and accounting standards, serving as a lender of last resort for credit organizations. After pointed date functions and powers of CBR were significantly expanded and the central bank received the status of a mega-regulator of all financial markets of Russia.[25]

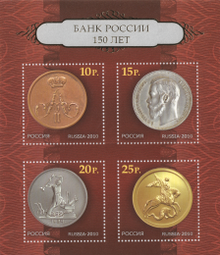

It holds the exclusive right to issue ruble banknotes and coins through the Moscow and St. Petersburg mints, the Goznak mint.[citation needed] The central bank issues commemorative coins made of precious and non-precious metals as well as investment ones made of precious metals, which are distributed inside and outside the country.[26] In 2010, in honor of its 150th anniversary it issued a 5-kilo commemorative gold coin Alexander II.[27]

Under Russian law, half of the bank's profit must be channeled into the government's federal budget. The Central Bank of Russia is a member of the BIS.[28]

The Bank of Russia owns a 57.58% stake in Sberbank, the country's leading commercial bank. The Bank of Russia also owns a 100% stake in Russian National Reinsurance Company (RNRC), the biggest national reinsurance company. The RNRC was established in July 2016 to prevent possible problems with reinsurance of large risks under international sanctions during the Russo-Ukrainian War, like constructing the Crimean Bridge.[29]

The Bank of Russia is actively working on financial literacy of the population. In particular, the Fincult project is developing a website with materials aimed at improving financial literacy of the population, combating fraud through a description of all fraudulent schemes.

The Bank of Russia is also involved in working with citizens' pension savings. Pensions in Russia remain very low. For 2024, the minimum social pension is set at 13,269 rubles (147 US dollars). Since there is not enough money in the budget, citizens are offered to save for retirement on their own. To this end, since 2024, the Bank of Russia and all its regional divisions have been actively promoting the Long-term Savings Program developed by the Bank of Russia.

The main feature of the long–term savings program is co-financing by the state. That is, citizens who have joined the program will receive an increase in their savings from the state for a certain time. Thus, people can form additional capital for their priority goals in the future, for example, to buy a home or educate children, create a financial "safety cushion" or use this money as an increase to a pension, she said in an interview Bankiros.ru representative of the Central Bank of the Russian Federation Larisa Pavlova.

Anti-fraud activities

[edit]A key prospective witness in improper financial affairs was Lyubov Tarasova (Russian: Любовь Тарасова) who was a senior auditor for the Central Bank of Russia and worked for the "Unicom" (Russian: "Юникон") auditing firm which had been established on 20 August 1991 and was responsible for "checking the correctness of the documentation and the essence of business transactions that are in doubt" (Russian: "проверка правильности документального оформления и сущности хозяйственных операций, вызывающих сомнение"), but was stabbed to death in her apartment in Moscow on 15-16 October 1997.[30][31][32]

In 2017, within the framework of a joint anti-phishing project of the Bank of Russia and search engine Yandex, a special check mark (a green circle with a tick and 'Реестр ЦБ РФ' (Bank of Russia Register) text box) appeared in the search results, informing the consumer that the website is really owned by a legally registered company licensed by the Bank of Russia.[33][34]

Governors

[edit]The President of the Board of Directors of the Central Bank is the head of the central banking system of the Russian Federation. The Governor is chosen by the President of Russia; and serves for four-year-terms after appointment. A Governor may be appointed for several consecutive terms (Sergey Ignatyev was the Governor of the Central Bank for 11 years, and he was appointed three times, in the longest serving term in post-soviet Russia).

| № | Name (governor) | Photo | Term of office | Appointed by | ||

|---|---|---|---|---|---|---|

| Start of term | End of term | Length of service | ||||

| 1 | Georgy Matyukhin |  | 25 December 1990 | 16 May 1992 | 1 year, 143 days (508 days) | Boris Yeltsin |

| 2 | Viktor Gerashchenko |  | 17 July 1992 | 18 October 1994 | 2 years, 93 days (823 days) | |

| 3 | Tatyana Paramonova |  | 19 October 1994 | 8 November 1995 | 1 year, 20 days (385 days) | |

| 4 | Alexander Khandruyev |  | 8 November 1995 | 22 November 1995 | 14 days (14 days) | |

| 5 | Sergei Dubinin |  | 22 November 1995 | 11 September 1998 | 2 years, 293 days (1,024 days) | |

| 6 | Viktor Gerashchenko |  | 11 September 1998 | 20 March 2002 | 3 years, 190 days (1,286 days) | |

| 7 | Sergey Ignatyev |  | 21 March 2002 | 23 June 2013 | 11 years, 94 days (4,112 days) | Vladimir Putin |

| 8 | Elvira Nabiullina |  | 24 June 2013 | present | 11 years, 245 days (4,263 days) | |

Subsidiaries

[edit]

The Central Bank of Russia holds directly significant participatory interests in a number of Russian companies:

- Sberbank of Russia (50%+1 voting share of the stock);

- Moscow Exchange (11.779% of the stock);

- Russian National Reinsurance Company (100% of the stock);

- Trust company of the Banking Sector Consolidation Fund (100% of the stock);

- Rosincas (Russian Association of Cash-in-transit).

Additionally, the Bank of Russia held earlier interests in some other Russian organizations. In particular, after the liquidation of Gosbank (State Bank of the USSR), the CBR beneficially acquired complete or controlling interests in five so-called "Russian Foreign Banks" (until 1991 – "Soviet Foreign Banks"):

- VTB Bank (99.99% of the stock – until 2002, now - 60.9% owned by The Federal Agency for State Property Management (Rosimushchestvo) );

- Donau Bank AG, Vienna;

- East-West United Bank, Luxemburg;

- Eurobank, Paris;

- Moscow Narodny Bank, London;

- Ost-West Handelsbank, Frankfurt am Main.

All of them were members of the USSR Vnesheconombank system and were transferred to the CBR in 1992 by the Resolution of the Presidium of the Supreme Soviet of Russia.[35] For over five years – 2000 to 2005 – all stocks of the Russian Foreign Banks were being purchased from the Bank of Russia by VTB Bank.[36][37][a] As part of the financial support to credit institutions, the Bank of Russia invests in them through the Banking Sector Consolidation Fund and acquires (on a temporary and indirect basis) shares in the equity of such banks. The first project of this kind was Otkritie FC Bank, in summer 2017.

Policies

[edit]

In December 2014, amidst falling global oil prices, international sanctions during the Russo-Ukrainian War, capital flight, and fears of recession, the bank had increased the one-week minimum auction repo rate up by 6.5 points to 17 percent. This caused a run on the ruble, and on 29 January, the bank decreased the rate by two points to 15 percent.

In January 2015, the head of monetary policy, Ksenia Yudayeva, a proponent of strict anti-inflation policy, was replaced by Dmitry Tulin, who is "seen as more acceptable to bankers, who have called for lower interest rates".[39]

In response to the 2021–2022 Russo-Ukrainian crisis, multiple countries imposed economic sanctions against Russian banks. On 22 February 2022, US president Joe Biden announced restrictions of activities by US citizens involved with the Bank of Russia and others.[40] In March, the Bank of International Settlements suspended the Bank of Russia.[41] In March 2022, the Depository Trust & Clearing Corporation blocked Russian securities from the Bank of Russia and Russia's finance ministry.[42] At the end of May 2022, three months into the invasion of Ukraine, the central bank cut interest rates in an effort to prop up the increasingly isolated Russian economy, suffering shortages and supply chain issues. The inflation rate rose to 17.8 percent in April. Also the ruble reached its strongest level against the U.S. dollar in four years, hurting exports.[43] The central bank announced a possible rate cut in 2025 due to stabilising inflation on the 1000th day of the Ukraine war.[44]

Sanctions also included asset freezes on the Russian Central Bank,[45] which holds $630 billion in foreign-exchange reserves,[46] to prevent it from offsetting the impact of sanctions.[47] On 5 May 2022, President of the European Council Charles Michel said: "I am absolutely convinced that this is extremely important not only to freeze assets but also to make possible to confiscate it, to make it available for the rebuilding" of Ukraine.[48]

See also

[edit]Notes

[edit]- ^ In 1998, "Northern Alliance" (Russian: «Северный Альянс») associated with Saint Petersburg included directors and shareholders of Tokobank (Russian: Токобанк) including Sudhir Gupta, owner of Amtel Tire Holding and controlled Yunicbank (Russian: Юникбанк), whose August 1998 head of the supervisory board was Stepan Kovalchuk (Russian: Степан Ковальчук), the chairman of the board of Flamingo Bank (Russian: банк «Фламинг»). Stepan Kovalchuk is a grand-nephew of Yuri Kovalchuk.[36][37][38]

References

[edit]- ^ Weidner, Jan (20 April 2017). "The Organisation and Structure ofCentral Banks" (pdf). portal.dnb.de. Darmstadt: Technische Universität Darmstadt. p. 296. Archived from the original on 28 May 2020. Retrieved 21 December 2021.

- ^ Central Bank of The Russian Federation. "International Reserves of the Russian Federation (End of period)". Archived from the original on 19 January 2023. Retrieved 1 March 2022.

- ^ "Bank of Russia increases the key rate by 200 bp to 21.00% p.a." Bank of Russia. 25 October 2024. Retrieved 6 December 2024.

- ^ a b "About Bank of Russia". cbr.ru. Archived from the original on 28 May 2022. Retrieved 28 May 2022.

- ^ "О Банке России | Банк России". cbr.ru. Archived from the original on 3 June 2022. Retrieved 28 May 2022.

- ^ "Constitution of the Russian Federation". Government of the Russian Federation archive.government.ru. Archived from the original on 25 October 2014. Retrieved 28 May 2022.

- ^ "Конституция Российской Федерации / Constitution of the Russian Federation (in Russian)". Government of the Russian Federation archive.government.ru. Archived from the original on 29 July 2021. Retrieved 28 May 2022.

- ^ a b "Federal Register / Vol. 87, No. 42 / Thursday, March 3, 2022 / Notices" (PDF). United States Department of the Treasury. 3 March 2022. Archived (PDF) from the original on 3 March 2022. Retrieved 27 May 2022.

- ^ History of the Bank of Russia. 1860–2010. In 2 vols. Ed.: Y. A. Petrov, S. Tatarinov. 2010.

- ^ "Constitution of the Russian Federation". Government of the Russian Federation archive.government.ru. Archived from the original on 25 October 2014. Retrieved 28 May 2022.

- ^ "Рейтинг банков | Банки.ру". Banki.ru. Retrieved 3 January 2020.

- ^ Johnson, Juliet (2000). A Fistful of Rubles.

- ^ a b c Prokopenko, Alexandra (19 October 2023). "Russia's Capital Controls Are Designed to Aid Putin's 2024 Re-Election". Carnegie. Retrieved 10 February 2025.

- ^ Roth, Andrew (16 August 2023). "Putin to discuss capital controls to help prop up rouble, report says". The Guardian.

- ^ a b c "Russia Extends Mandatory FX Conversion for Major Exporters". Barron's. AFP.

- ^ "Russia tightens capital controls on western companies". Financial Times. 19 October 2023. Retrieved 10 February 2025.

- ^ "The Central Bank of the Russian Federation closed the statistics of the over-the-counter currency market". Interfax. 15 July 2024. Retrieved 10 February 2025.

- ^ a b "Bank of Russia increases the key rate by 200 bp to 18.00% p.a. | Bank of Russia".

- ^ "Russian Central Bank hikes rates". Reuters. 26 July 2024. Retrieved 10 February 2025.

- ^ "Россия начала закупать долларовые банкноты в Африке". 2 September 2024.

- ^ "Russia's Central Bank Raises Rates to 19% as Inflation Ticks up". 13 September 2024.

- ^ "As war in Ukraine worsens inflation, Russian central bank hikes rates - National | Globalnews.ca".

- ^ "Russia's central bank hikes interest rates in a bid to fight inflation". 13 September 2024.

- ^ "Banking Legislation". Bank of Russia. Archived from the original on 17 October 2017.

- ^ "Elvira Nabiullina: Establishing a mega regulator for the Russian financial sector" Archived 17 October 2017 at the Wayback Machine, Bank for International Settlements : Central bankers' speeches : Speech by Ms Elvira Nabiullina, Governor of the Bank of Russia, at the Federation Council, Moscow, 15 February 2017.

- ^ "Commemorative Coins – Banknotes and Coins – Bank of Russia". cbr.ru. Archived from the original on 29 January 2013. Retrieved 28 January 2013.

- ^ "Russia to issue 5 kg gold coin" Archived 23 May 2010 at the Wayback Machine, The Financial Express. 19 May 2010. Accessed 19 May 2010.

- ^ Hilsenrath, Jon; Blackstone, Brian (12 December 2012). "Inside the Risky Bets of Central Banks". wsj.com. The Wall Street Journal. Archived from the original on 22 December 2017. Retrieved 21 December 2021.

- ^ "Putin signed a law establishing a National reinsurance company" Archived 27 May 2020 at the Wayback Machine, World News, Breaking News, 4 July 2016.

- ^ "Arthur Christy. Inkombank lawyer former US Attorney: US lawyers hired as spin doctors for Russian mob". US-Russia Press Club. 30 April 1999. Archived from the original on 1 July 2007. Retrieved 10 April 2021 – via russianlaw.org.

- ^ "Убили аудитора: Убит хранитель тайн Центробанка" [The auditor was killed: Keeper of secrets of the Central Bank killed]. Kommersant (in Russian). 18 October 1997. Archived from the original on 11 April 2021. Retrieved 8 April 2021.

- ^ "били аудитора: Кого проверяла Любовь Тарасова" [The auditor was killed: Whom Lyubov Tarasova checked]. Kommersant (in Russian). 18 October 1997. Archived from the original on 11 April 2021. Retrieved 10 April 2021.

- ^ "Bank of Russia to mark microfinance organisations on the Internet | Банк России". www.cbr.ru. Archived from the original on 23 October 2020. Retrieved 16 August 2017.

- ^ "Insurers' websites receive first marks | Банк России". www.cbr.ru. Archived from the original on 23 October 2020. Retrieved 14 February 2018.

- ^ Овчинников, О. (Ovchinnikov, O.) (8 November 2000). "ЦБ - центральный Банд ..." [Central Bank - Central Gang ...]. Compromat.ru (in Russian). Archived from the original on 23 April 2021. Retrieved 10 April 2021.

{{cite news}}: CS1 maint: multiple names: authors list (link) - ^ a b ""Дочерние" российские зарубежные банки и сеть ВТБ: доли ЦБ, ВТБ и др" [Russian Foreign "Daughter" Banks and the VTB Network: stakes held by Central Bank, VTB, others]. compromat.ru. February 2005. Archived from the original on 16 March 2022. Retrieved 15 July 2021.

- ^ a b Бирман, Александр (Birman, Alexander) (21 February 2005). "В советских сетях: Нефтедоллары пойдут по проверенным каналам загранбанков" [In Soviet networks: Oil dollars will go through proven channels of foreign banks]. Компании Деловой Еженедельник (ko.ru). Archived from the original on 13 March 2005. Retrieved 15 July 2021.

{{cite news}}: CS1 maint: multiple names: authors list (link) - ^ Рубин, Михаил (Rubin, Mikhail); Баданин, Роман (Badanin, Roman) (28 November 2018). "Телега из Кремля. Рассказ о том, как власти превратили Telegram в телевизор" [A cart from the Kremlin. The story of how the authorities turned Telegram into a TV]. Проект (proekt.media) (in Russian). Archived from the original on 11 January 2019. Retrieved 15 July 2021.

{{cite news}}: CS1 maint: multiple names: authors list (link) - ^ Jason Bush, Lidia Kelly and Alexander Winning (30 January 2015). "Russian central bank makes surprise interest rate cut". Reuters. Archived from the original on 30 January 2015. Retrieved 31 January 2015.

- ^ "Fact Sheet: United States Imposes First Tranche of Swift and Severe Costs on Russia". The White House. 22 February 2022. Archived from the original on 9 April 2022. Retrieved 23 February 2022.

- ^ "IMF approves $1.4 billion Ukraine aid and BIS suspends Russia". Central Banking. 10 March 2022.

- ^ Lomax, Securities Finance Times reporter Jenna (2 March 2022). "DTCC blocks Russian securities from Bank of Russia". www.securitiesfinancetimes.com. Archived from the original on 23 April 2022. Retrieved 23 April 2022.

- ^ Cohen, Patricia; Nelson, Eshe; Safronova, Valeriya; Levenson, Michael (26 May 2022). "As Russia Diverges From the Global Economy, Soviet-Style Scarcity Looms". The New York Times. ISSN 0362-4331. Archived from the original on 27 May 2022. Retrieved 27 May 2022.

- ^ "Central Bank of Russia could begin cutting key rate in 2025 if inflation slows, absent any shocks - Nabiullina". interfax.com. Retrieved 19 November 2024.

- ^ Kirschenbaum, J. (16 May 2022). "Now is not the time to confiscate Russia's central bank reserves". Bruegel. Archived from the original on 2 July 2022. Retrieved 15 June 2022.

- ^ Davidson, Kate; Weaver, Aubree Eliza (28 February 2022). "The West declares economic war on Russia". Politico. Archived from the original on 1 March 2022.

- ^ Pop, Valentina (25 February 2022). "EU leaders agree more Russia sanctions, but save some for later". Financial Times. Archived from the original on 26 February 2022.

- ^ "Germany open to Russian Central Bank asset seizure to finance Ukraine's recovery". Euractiv. 17 May 2022. Archived from the original on 25 October 2022. Retrieved 15 June 2022.

Further reading

[edit]- Barenboim, Peter (2001). "Constitutional Economics and the Bank of Russia". Fordham Journal of Corporate and Financial Law. 7 (1): 160.

External links

[edit]- Bank of Russia (in Russian and English)

- (in Russian) Creation of the State Bank of the Russian Empire

- (in Russian) State Bank of the Russian Empire at the site of the Central Bank of the Russian Federation

- (in English) State Bank of the Russian Empire at the site of the Central Bank of the Russian Federation

French

French Deutsch

Deutsch